42+ calculate mortgage interest tax deduction

The good news if you have a bigger mortgage is. Also known as the SALT deduction it allows taxpayers to deduct up to 10000 of any state and local property taxes plus.

Gutting The Mortgage Interest Deduction Tax Policy Center

However higher limitations 1 million 500000 if married.

. Discover Helpful Information And Resources On Taxes From AARP. Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. Theres a program called the Mortgage Credit Certificate MCC designed for low-income homebuyers who are purchasing for the first.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Our Free Tax Calculator Is a Great Way to Learn about Your Tax Situation. The amount of money you borrowed.

X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. In most cases homeowners. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Homeowners who are married but filing.

Ad TaxInterest reports are widely recognized by Tax authorities for accuracy and detail. Mortgage Tax Credit Deductions. Taxes Can Be Complex.

So the total Interest that is 1000000 5. Ad Our Free Tax Calculator Is a Great Way to Learn about Your Tax Situation. Use our free calculator to estimate what your mortgage interest payments will look like.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

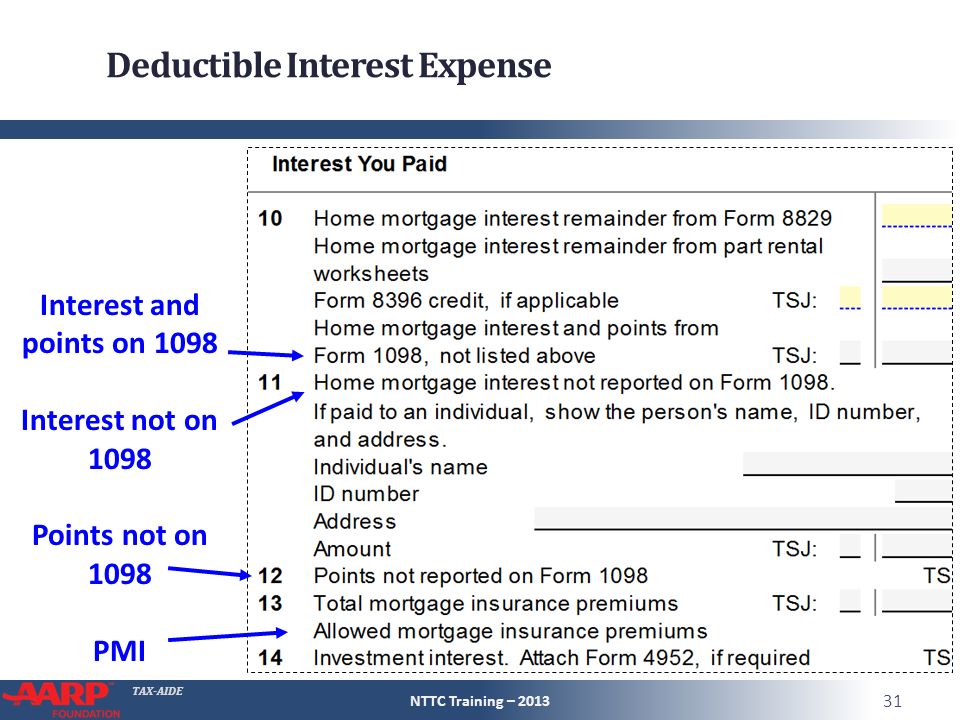

Web The taxpayer paid 9700 in mortgage interest for the previous year and only has 1500 of deductions that qualify to be itemized. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web In our example if you were to take out a 200000 30-year loan at 4 interest youd get to take a mortgage interest deduction of 7936 your first year but just a 244 deduction. This is the total amount of the loan that you borrowed in order to purchase your home. Web Calculate Interest payment as shown below.

Take note that this. Web The home mortgage interest deduction HMID is one of the most cherished American tax breaks. Taxes Can Be Complex.

Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a. Homeowners who bought houses before December 16. Web The traditional monthly mortgage payment calculation includes.

In truth the myth is often better than reality. The standard deduction for a. Web 371 rows Mortgage Interest Tax Deduction Calculator to calculate how much tax you.

Web Calculating your mortgage interest payments isnt complicated. Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Like the HELOC interest deduction the mortgage interest tax deduction only applies when you choose to itemize your deductions. The cost of the loan. Web Mortgage Tax Deduction Calculator Definitions Total Home Loan Amount.

Web Deduction for state and local taxes paid. Web To get the remaining balance on the mortgage deduct the amount that you paid toward the principal in the first month of the mortgages first year. Please note that if.

Web The home office tax deduction is a way for self-employed people to deduct certain expenses associated with their home office such as rent or mortgage interest utilities. Prepare for tax season with the interest calculation tool relied upon by the IRS. Web As outlined by IRS regulations single-file taxpayers and married couples filing joint taxes can deduct home mortgage interest on the first 750000 or 375000 if youre married.

Abraxasdecember2016catal

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Payment Tax Calculator Deduction Calculator

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

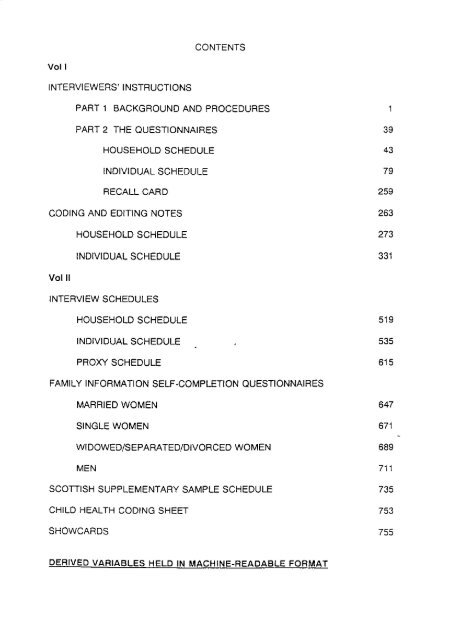

Contents Vol I Interviewers Instructions Part 1 Esds

The History And Possible Future Of The Mortgage Interest Deduction

Mortgage Interest Deduction How It Calculate Tax Savings

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Pdf The Role Of Stakeholder Understanding In Aligning It With Business Objectives Jacob L Cybulski Academia Edu

List Of 7 Useful Wordpress Calculator Plugins 2023 Engine Templates

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Cash Out Refinancing What Is It Rates Pros And Cons Vs Home Equity Loan 2021 Cain Mortgage Team

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Tax Deduction What You Need To Know

Vol 17 Issue 9 By Weekly Link Issuu

Keep The Mortgage For The Home Mortgage Interest Deduction